© Wild Oats Publishing 2024

Wild Oats Grain Market Advisory

Site Created August 15, 1996; Last Updated April 09, 2024

Web site created by Branscombe Consulting

Wild Oats is published 40 times per year by Wild Oats Publishing, 905 - 167 Lombard Avenue,

Winnipeg R3B 0V3. Tel. (204) 942-1459 Fax (204) 942-7652 E-mail: wildoats@canadagrain.com

Information is secured from sources believed reliable, but 100% accuracy cannot be guaranteed.

Persons associated with Wild Oats deal commercially with businesses active in Prairie grain markets

and may hold positions on their own accounts in commodities discussed herein. ISSN 1185-2194

Copyright 2022. All rights reserved. The Wild Oats Grain Market Advisory is protected by copyright.

Copying, retransmission or redistribution, in whole or in part, without the prior written approval of Wild

Oats Publishing is strictly prohibited.

Manitoba Farmgate Prices

Prices are FOB farm, unless noted otherwise, as of December 13, 2022. Your local rate may differ.

Basis

Net

Per Bushel

Canola: Prices under Jan at $876

Del Elevator

10 - 47

829 - 866

18.81 - 19.65

Fall 2023 (Del Elev)

15 - 25

801 - 811

18.17 - 18.39

Bunge (del)

Altona: $19.30 (Dec); $19.57 (Jan); $19.69 (Mar)

Harrowby: $19.28 (Dec); $19.51 (Feb); $18.19 - 18.26 (Fall 2023)

Nexera: $21.32 - 21.68 (Dec); $21.62 - 21.82 (Mar); $21.37 (Fall 2023)

Barley

Feed Del Elevator

344 - 356

7.50 - 7.75

Malt Del Elevator: $9.00 del (Jan); $9.15 (Mar); Fall 2023: $8.00

Wheat

Feed Del Elevator

331 - 404

9.00 - 11.00

Milling Wheat (Del Elev)

CWRS #1

423 - 434

11.52 - 11.82

CWRW #2 (del)

414

11.28

Flax

$18.52 del; $19.00 - 20.00 del Sk

Oats

$4.10 - 4.45 del; Fall 2023: $4.55 del

Corn

$7.00; $8.75 - 9.36 del; Fall 2023: $7.25 - 7.39

Soybeans

$18.86 - 19.31 del; Fall 2023: $16.54 - 17.27

Lentils

Laird #1: 50 - 52¢ del; #2: 50 - 52¢ del; X3: 45 - 47¢ del; #3: 40 - 42¢ del

Eston: #1: 44 - 49¢ del; #2: 45.5 - 48¢ del; X3: 32 - 34¢ del; #3: 32 - 34¢ del

Richlea: #1: 40 - 51¢ del; #2: 37 - 47¢ del; X3: 32 - 34¢ del; #3: 32 - 34¢ del

Crimson: #2+: 33 - 35¢ del; X3: 31 - 33¢ del; #3: 28 - 30¢ del

Canary Seed

37 - 39¢; 40 - 41¢ del

Peas:

Green: $13.00 - 14.00 del Sk; Fall 2023: $11.60 - 12.00 del Sk

Yellow: $12.00 - 13.20 del Sk; Fall 2023: $10.00 - 11.00 del Sk

Feed: $10.00 - 12.45 del

Mustard

Yellow: $1.05 - 1.20 del Sk; Fall 2023 (FOB Farm Sk): 85 - 87¢

Brown: $1.00 - 1.15 del Sk; Fall 2023 (FOB Farm Sk): 78 - 80¢

Oriental: $1.05 - 1.20 del Sk; Fall 2023 (FOB Farm Sk): 76 - 78¢

Delivered North Dakota Plant/Elevator - $US/bu [$CND/bu in brackets]

DNS [14%]: $8.67 - 8.98 [$11.75 - 12.178]; Fall 2023: $8.03 - 8.19 [$10.89-11.10]

Durum: $8.00 - 10.00 [$10.85 - 13.56]

Flax: $15.00 - 16.50 [$20.48 - 22.53]

Corn: $5.84 - 6.29 [$7.92 - 8.53]; Fall 2023: $5.13 - 5.37 [$6.95 - 7.28]

Barley Feed: $4.00 - 5.26 [$5.42 - 7.13]; Malt: $4.50 - 6.01 [$6.10 - 8.15]

Soybeans: $14.20-14.54 [$19.25-19.71]; Fall 2023: $12.97-13.12 [$17.58-17.79]

Canola: $13.68 - 14.80 [$18.54 - 20.06]; Fall 2023: $12.50-13.14 [$16.95-17.81]

Sunflower NuSun: 21.9 - 24.4¢ [29.6 - 33.1¢]; Fall 2023: 23.3-26.4¢ [31.5-35.7¢]

Peas Yellow: $8.50 - 11.25 [$11.53 - 15.25]

Peas Green: $8.50 - 11.00 [$11.53 - 14.91]

Pinto: 34.0 - 35.0¢ [46.1 - 47.4¢]; Navy: 38.0¢ [51.5¢]

Black: 40.0 - 42.0¢ [54.2 - 56.9¢]

Kidney Lgt Red: 46.0 - 50.0¢ [62.4 - 67.8¢]; Drk Red: 45.0 - 48.0¢ [61.0 - 65.1¢]

Saskatchewan Farmgate Prices

Prices are FOB farm, unless noted otherwise, as of December 13, 2022. Your local rate may differ.

Basis

Net

Per Bushel

Canola: Prices under Jan at $876

Del Elevator

16 - 43

833 - 860

18.90 - 19.51

Fall 2023 (Del)

13 - 49

777 - 813

17.62 - 18.43

Bunge (Del)

Nipawin: $19.51 (Dec); $19.42 (Jan)

Dixon: $19.20 (Feb); $19.29 (Mar); $18.01 - 18.06 (Fall 2023)

Nexera: $20.74- 21.04 (Dec); $20.63 - 21.31 (Mar); $20.65 (Fall 2023)

Barley

Feed Del Elevator

344 - 367

7.48 - 8.00

Fall 2023 (del)

312 - 322

6.80 - 7.00

Malt (Del): $8.30 (Feb); $8.40 (Apr)

Wheat

Feed Del Elevator

367 - 413

10.00 - 11.25

FOB Farm

367 - 404

10.00 - 11.00

Milling (Del)

CWRS #1

417 - 431

11.36 - 11.73

Fall 2023

370 - 375

10.08 - 10.21

CPRS #1

391 - 412

10.65 - 11.20

Durum

484 - 498

13.17 - 13.56

Fall 2023: not quoted

Flax

$17.00 - 19.00; $19.00 - 20.00 del

Oats

$3.46 - 3.64 del; Feed (Spot): $3.25 - 3.75

Lentils

Laird #1: 50 - 52¢ del; #2: 48 - 50¢; 50 - 52¢ del; X3: 45 - 47¢ del

#3: 40 - 42¢ del

Eston: #1: 46 - 48¢; 44 - 49¢ del; #2: 45.5 - 48¢ del; X3: 32 - 34¢ del

#3: 32 - 34¢ del

Richlea: #1: 40 - 51¢ del; #2: 37 - 47¢ del; X3: 32 - 34¢ del; #3: 32 - 34¢ del

Crimson: #2+: 32 - 33¢; 33 - 35¢ del; X3: 31 - 33¢ del; #3: 28 - 30¢ del

Canary Seed

37 - 39¢; 40 - 41¢ del

Peas

Green: $13.00 - 14.00 del; Fall 2023: $11.60 - 12.00 del

Yellow: $12.00 - 13.20 del; Fall 2023: $10.00 - 11.00 del

Feed Peas: $10.00 - 12.45 del

Chickpeas

Kabuli (del): 10mm: 55 - 55.5¢; 9mm: 54 - 55¢; 8mm: 52 - 53¢

Mustard

Yellow: $1.15 - 1.18; $1.05 - 1.20 del; Fall 2023: 88 - 87¢; 85 - 88¢ del

Brown: $1.10 - 1.18; $1.00 - 1.15 del; Fall 2023: 78 - 80¢; 75 - 80¢ del

Oriental: $1.10 - 1.20; $1.05 - 1.20 del; Fall 2023: 76 - 78¢; 75 - 80¢ del

Alberta Farmgate Prices

Prices are FOB farm, unless noted otherwise, as of December 13, 2022. Your local rate may differ.

Basis

Net

Per Bushel

Canola: Prices under Jan at $876

Del Elevator

5 - 46

831 - 871

18.84 - 19.76

Bunge

5

871

19.76

Fall 2023 (Del Elev)

18 - 42

784 - 808

17.78 - 18.33

Nexera (Del): $21.35 (Dec-Jan); $21.06 (Mar); $21.07 (Fall 2023)

Barley

Feed Del Elevator

337 - 450

7.34 - 9.80

Lethbridge

440 - 450

9.58 - 9.80

Vermillion

415 - 428

9.04 - 9.32

Rycroft

337 - 415

7.34 - 9.04

Fall 2023 (Del)

312 - 322

6.80 - 7.00

Malt Del: $8.60 (Feb);8.70 -8.75 (Apr); Fall 2023 (Del): $7.40 - 7.80

Wheat

Feed Del Elevator

367 - 460

10.00 - 12.52

Lethbridge

440 - 460

11.97 - 12.52

Red Deer

441 - 450

12.00 - 12.25

Viking

367

10.00

FOB Farm; not quoted

Milling (Del Elev)

CWRS #1

420 - 439

11.42 - 11.95

Fall 2023

370 - 405

10.08 - 11.01

CPRS #2

402 - 418

10.95 - 11.37

Fall 2023

349 - 350

9.50 - 9.53

Durum

497 - 499

13.52 - 13.57

Oats

Del Elevator

243 - 335

3.75 - 5.17

Edmonton

285 - 335

4.40 - 5.17

Viking

243

3.75

Fall 2023

259

4.00

Flax: $17.10 del

Corn: $11.66 del

Lentils

Laird #1: 50 - 52¢ del Sk; #2: 50 - 52¢ del Sk; X3: 45 - 47 del Sk

#3: 40 - 42¢ del

Eston: #1: 44 - 49¢ del Sk; #2: 45.5 - 48¢ del Sk; X3: 32 - 34¢ del Sk

#3: 32 - 34¢ del

Richlea: #1: 40 - 51¢ del Sk; #2: 37 - 47¢ del Sk; X3: 32 - 34¢ del Sk

#3: 32 - 34¢ del

Crimson: #2+: 33 - 35¢ del Sk; X3: 31 - 33¢ del Sk; #3: 28 - 30¢ del Sk

Canary Seed

37 - 39¢; 40 - 41¢ del

Peas

Green: $13.00 - 14.00 del Sk; Fall 2023: $11.60 - 12.00 del Sk

Yellow: $12.00 - 13.20 del Sk; Fall 2023: $10.00 - 11.00 del Sk

Feed: $12.31 - 13.20 del

Mustard

Yellow: $1.05 - 1.20 del Sk; Fall 2023: 85 - 87¢ FOB Farm Sk

Brown: $1.00 - 1.15 del Sk; Fall 2023: 78 - 80¢ FOB Farm Sk

Oriental: $1.05 - 1.20 del Sk; Fall 2023: 76 - 78¢ FOB Farm Sk

Delivered Montana Elevator - $US/bu [ $CND/bu in brackets ]

DNS [14%]: $8.26 - 9.02 [$11.20 - 12.23]; Durum: $9.00 - 9.50 [$12.20 - 12.88]

HRW [13%]: $7.82 - 8.94 [$10.60 - 12.12]

Barley: Feed: $6.25 - 6.50 [$8.47 - 8.81]; Malt: $7.50 - 7.60 [$10.17 - 10.30]

From the Floor

Opinion derived from traders

If our government's action sometimes makes you wonder, well it could be worse.

In Mexico a new "clean everything up" President decreed that GM corn could not be imported, starting in

2024. Mexico is a large buyer, taking over 16 million tonnes, annually. This is irrational and purely

emotional and will hurt Mexican corn users and consumers, American farmers and growers of feed grains

around the world. It is so destructive that it will presumably never be implemented.

In the United States, the Biden administration last week gave $36 billion dollars of taxpayers' money to

bail out the Teamsters' Union pension plan that had run out of money because of underfunding. It was the

payoff for legislating an end to the proposed national rail strike.

On second thought, perhaps $36 bln is cheap. After all, it'll be up to another administration to deal with

the precedent that unions can shake down the government.

Street Smart - Gary Halvorson

If we're going to use more renewable diesel fuel we need 9 mln more acres of soybeans.

Gary Halvorson is a vice-president of CHS Inc.

Renewable Diesel Production Surges

Renewable diesel - diesel that is green and low carbon -

production is surging. It has doubled in the past year and likely to

hit 5.5 billion gallons by 2026 in the United States. It is driven by

state low-carbon fuel mandates and has the potential to do to

soybean use what ethanol did to corn use 20 years ago.

INTERNET EDITION

Volume 30 Number 16

December 13, 2022

Re-broadcast, re-distribution and/or forwarding of the Wild Oats Grain Market Advisory, including

internally within offices and organizations, is prohibited.

Oat Market Slow - John Duvenaud

Remember the new-crop oats market last spring?

The 2021 oat crop had been a disaster and

established commercial oat processors were hard-

pressed to keep their facilities running. Meanwhile

a few new oat milk processors had been built in the

United States and the MBAs running them were

determined that wouldn't happen to them.

Accordingly, you could contract new-crop oats for

$7.50/bu in the Red River Valley and $7/bu in

northeast Saskatchewan right during seeding. Lots

of farmers took advantage and lots of oats were

contracted.

As it turned out, 2022 was a great oat production

year. Contracted oats have been pouring onto the

system since harvest started. Even today, in the

middle of December, it's difficult to move oats. You

can probably sell them, for maybe $5/bu but

delivery will be Jan/Feb/Mar.

If you want to move your oats today you may be

able to move them, in the feed market, for $3.50 -

$4.00/bu, but delivery may still be Jan/Feb.

Oats prices have had a pretty good tumble. They

were still trading in the $7/bu range last summer

but as the crop developed prices tanked. By

September they were trading from under $4.00/bu

to close to $5.00. They were generally flat through

fall but have eased a further 50 cents/bu in just the

last week, according to Prairie Ag Hotwire.

The feed market is interesting. Barley trades

around $7.50/bu fob farm in Saskatchewan so

$4.00/bu oats make sense. Logistics, however, are

a problem. There was a flurry of movement of oats

to Feedlot Alley in Alberta earlier this fall but

volumes dropped off after the first corn trains

started arriving.

It's hard to know how many oats have moved into

the feed market. The numbers work but it's all

private sales and shipping and therefore there are

no public records. All we can say is that some

amount of milling oats have been taken off the

market. In comparison to the 4.6 million tonnes we

produced it might not be that significant. On the

other hand, total feed use in Canada is enormous.

Between barley, feed wheat, peas and imported

corn it totals some 12 million tonnes so even

minimal participation of oats could be a sizable

number.

The short ( and medium) term trend in oat prices

is down and it is not inconceivable that prices go

even lower. Prairie Crop Charts says

Saskatchewan elevator prices for milling oats

compared to CBT corn futures are testing their

cheapest levels in a decade. Wheat, barley and

peas are, more or less, in line with CBT corn. Oats

are off-the-charts cheap. It may be that the worst of

the decline is behind us.

Wild Oats is 40% priced on oats. We're reluctant

to recommend an additional sale when you can't

move them anyway. The prairie oat industry is

plugged but there's a big commercial oat-using

industry in North America. They will have to

replenish their raw material supplies before spring

so don't write off the year quite yet.

New-crop is where the opportunity lies. At

$4.20/bu, where you can contract it today, not many

farmers are going to plant oats this spring. Not with

$12.00/bu spring wheat new-crop bids. The trade is

worried about new-crop oats. Do not sign up your

new-crop oats.

than offset an increase in Australian output. With

the Black Sea shipping agreements holding,

Ukraine and Russian exports were raised.

Global coarse grain production is reduced and

only partially offset by lower consumption.

Ending stocks are 3% lower than beginning.

Ukraine corn was seeded after the onset of

hostilities and as a result production is down

sharply. The harvesting of both Ukraine and

Russian corn has been plagued by wet weather.

Oilseed production was lowered as an

increase in soybean output was offset by lower

forecasts for most other oilseeds.

Russians Attack Odessa Port

Over the weekend Russian missiles damaged

export facilities at the Ukrainian port of Odessa.

Wheat futures surged on Monday.

Good Week for Futures

All grain and oilseed futures are stronger in the

past week with the best gains in wheat. The

Russian attacks in Odessa had all wheats

strongly higher in Monday trade. Funds had

been heavily short wheat and rebuying of those

shorts accelerated the buying. Chicago was

down today (Tuesday) but Minneapolis is higher

again. The U.S. hard red spring carryout is

estimated at 119 mln bushels by USDA, the

lowest level since 2008.

Canola, beanoil and soybeans are all strongly

higher. It rained in Argentina, which should be

bearish but the main effect seemed to be an

unwrapping of the short meal/long soyoil spread.

Soymeal had been on fire, climbing $30/ton on

the last week before losing $20 on Monday.

Soyoil is currently very strong.

Statistics Canada Confirms Barley Production

Near 10.0 million mt - Jerry Klassen

Canadian farmers harvested a barley crop of

9.986 million tonnes this past fall, up from the 2021

output of 7.0 mmt and up from the five-year average

of 9.2 million. We were expecting a crop size of 10.0

mmt, therefore, this was not a surprise to the trade.

We project the 2022/23 barley carryout to finish

near 1.5 mmt, up from the five-year average of 1.2

mmt. We expect the barley market to remain under

pressure with U.S. corn actively trading into

Southern Alberta. U.S. corn is trading into Southern

Alberta in the range of $455-$462/mt.

This past week, barley was trading at $440-

$450/mt delivered Lethbridge for Jan/March

delivery. For September through December

positions, feed barley was trading in the range of

$390-$395/mt.

In Central Alberta, feedlot operators were showing

bids of $410-$420/mt. Elevators were showing bids

for $340-$350/mt for September through December

delivery.

The Black Sea Grain Initiative was extended by

120 days ensuring smooth exports until the latter

half of March 2023. Ukraine feed barley is offered at

US$260/tonne fob Black Sea port for January

shipment, down approximately US$30/tonne from

mid-November. French feed barley is offered at

US$295/tonne, down US$23/tonne from mid-

November. The world market has been trending

lower since the Black Sea Initiative was extended.

Wild Oats is 60% sold on feed and malt barley.

We are expecting the barley market to trend lower

into spring.

Sell 20% of Durum Production

Sell 20% of your durum bringing total sales to

60%. Durum production came in at 5.4 million

tonnes on Statistics Canada’s final crop survey. This

was below the September model-based survey of

6.1 mmt and below the five-year average of 6.0

million tonnes. If we account for carryin stocks, total

supplies for the 2022/23 crop year are estimated at

5.8 mmt, down from the five-year average of 7.4

mmt. The lower production estimate was a shock to

the trade.

Durum prices have strengthened since the

Statistics Canada production report. The durum

market is incorporating a risk premium due to the

lower production estimate. The market may have to

ration demand given the fact that all three major

durum exporters had production below the five-year

average. We want to be selling into this strength.

Algeria and Tunisia are expected to tender over the

next couple of weeks. This will set the price

structure moving forward.

We want to bring sales to 60% and we still have

40% for a major rally. Keep in mind that prices are

at the highest levels for the crop year. We are

selling into the upper third of the price range for the

crop year. Remember, European and North African

harvests begin in the latter half of May. The critical

period for yield development for these crops is

March. At the same time, the durum market will

need to encourage acreage in Canada and the U.S.

for 2023/24.

We are planning to make our next 20% sale in

spring. Wild Oats always leaves 20% until the

upcoming crop is more certain.

American Supply/Demand

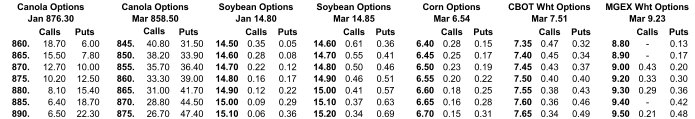

USDA - December 9, 2022

Corn

Wheat

21/22

22/23

22/23

21/22

22/22

22/23

Dec

Nov

Dec

Dec

Nov

Dec

Production

14,182

14,750

14,996

1,826

1,697

1,697

Supply

16,127

15,892

16,209

2,955

2,686

2,676

Feed

5,725

5,625

5,700

97

160

160

Ethanol

5,035

5,200

5,200

Exports

2,745

2,400

2,475

992

875

875

Total Use

14,940

14,650

14,800

2,111

2,059

2,061

Carryout

1,187

1,242

1,408

844

626

615

Soybeans

Production

4,136

4,339

4,374

Supply

4,680

4,533

4,574

Crush

2,140

2,205

2,180

Export

2,260

2,055

2,090

Total Use

4,505

4,378

4,388

Carryout

175

155

185

Note: Units in million bushels

Adjustments were limited. There was minimal reaction

in futures.

Wheat ending stocks were unchanged, 3% below

beginning stocks. Corn components of domestic

demand were unchanged but in view of slow sales to

date exports were lowered and ending stocks raised by

6% but still 9% below beginning stocks. Soybeans were

unchanged with ending stocks 1% below beginning

stocks. Anticipated adjustments to U.S. ..biofuel

programs are expected to result in lower soybean oil

use for this purpose which together with lower exports is

expected to result in an increase in ending stocks for

soyoil.

USDA Global Report Mildly Bearish

The global outlook for wheat is for reduced supplies,

lower consumption and a small reduction in ending

stocks, now 3% above beginning stocks. Lower

estimates for Canadian and Argentine harvests more

![Change* Contract Int. Open Hi Low Change* n.c. 961 768 Soybeans 778 773 Low 14.80 n.c. 939 788 Mar 820.10 +1.40 0 HRS Jul 9.14 +0.15 Minneapolis Grain Exchange Close Change* Open Change* Contract Int. Hi +0.27 30837 +1510 13.90 -0.05 -0.04 3176 +213 88990 +2231 13.63 7.11 10.36 -0.06 HRW 7.29 Jan 824.30 +1.40 257 Low Wheat Mar 9.23 Wheat Mar 8.65 +0.35 +0.08 4410 +572 11.50 Mar 449.9 12.61 8.38 7.79 12.10 8.47 +0.01 14.14 n.c. Close Change* China's Dalian Commodity Exchange ($U.S.) Close Low Jul 14.14 n.c. Jan 582.26 +5.02 13.67 May Mar Nov 10.28 -0.06 Soymeal Dec 625.25 +15.78 Wheat 14.28 +0.01 Jul 360.3 160649 360.0 449.3 +30458 140043 +8118 77.77 Jan 452.3 +3.7 84028 +2.13 58418 +2799 +0.25 53.97 May 62.79 +2.26 74642 +3008 76.73 53.92 11.96 1092 779 15.88 May 14.89 +0.20 95578 Jan 90853 +13548 +2356 25934 +3134 37818 61302 +1393 Winnipeg Grain Exchange Chicago Board of Trade Open Change* Contract Close Change* Close Hi +12.10 May 24624 1126 -15630 1131 Int. +6.80 Nov 826.00 +0.50 Soybean Canola Jan 876.30 965 730 1085 780 +26.80 854.50 Jul 20.73 Jul 851.80 Sep 8.99 Oil Soybean Meal Mar 858.50 +18.80 May 20.78 -0.67 10.31 May Mar 21.17 -0.31 10.26 Mar 14.85 +0.23 210158 +41760 15.72 12.26 176236 -45167 51.67 Jul 14.92 +0.18 75285 84087 -42189 78.78 Jan 64.12 12.65 +526 15.63 12.99 -872 15.68 +2.50 Mar 63.37 +2.37 Jul 8.49 +0.27 21440 535.84 +12.74 531.12 +13.32 Jan Mar Change* Jan -0.66 SGluten 8.22 Soybeans Jan 21.66 -0.19 8.50 +0.25 10212 8.54 +0.25 5105 7.53 Dec Hi +1834 11.59 +323 11.28 -185 Int. Sep Kansas City Board of Trade Close Change* Open Change* Contract +1145 n.c. 5.80 3.27 72.00 +1440 107.55 94.43 76.40 +1077 80.33 72.25 [*Futures for December 13, 2022. Change since December 06, 2022] Corn Mar Jun 73.98 +0.52 2646 Dollar Mar 73.86 +0.48 32569 +23361 80.26 72.13 Canadian Dec 73.77 +0.52 120354 -7320 80.91 Jun 105.55 +0.50 22404 Apr 91.35 -1.45 42374 96.75 82.63 +2720 156.40 146.35 Lean Hogs Feb 84.58 -2.35 73727 -7472 93.33 Jun 156.28 +1.80 52435 +2217 159.65 150.68 Dec 9.02 +0.06 1108 +191 11.20 8.77 Apr 160.05 +2.43 68313 129174 -3299 157.05 142.88 Live Cattle Feb 156.35 +2.72 3 Change* Contract Hi Low +0.08 102 Open Close Change* Int. Chicago Merchantile Exchange Dec 3.35 +0.06 Sep 3.35 Jul 3.40 6.04 3.29 11.31 7.27 11.20 7.61 3.31 6.25 3.27 7.84 +0.19 20160 +2 -770 +24 3.41 +0.04 +0.06 30 7.72 +0.18 15536 +1854 7.04 Jul 7.66 +0.20 65572 +2172 11.61 7.08 7.50 +0.21 5.32 Dec 5.96 +0.03 147268 +1706 6.79 5.43 373.6 7.69 5.03 Jul 6.48 +0.12 210415 -2440 7.60 5.49 +0.17 569287 6.54 6.09 +0.05 79971 Corn Mar Oats Mar Sep Wheat Mar Sep Dec 75.63 3577 +331 6.14 -22793 +2151 7.02 178961 +314 12.73 35156 +436 443.1 -43598 453.2 Jul 442.3 +0.5 +4.0 53.56 May 445.5 +2.0 71561 +11866 445.5 373.3 Jul 62.28](index_html_files/19116.png)